Bitcoin Bounces & The Fed Pulls Small Banks' Life Support

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Download Theya on the App Store and declare your sovereignty today.

What a week just passed! Let's break it all down and look ahead to what's next.

The outflows from Grayscale's bitcoin ETF have decelerated in recent days from more than $600 million in daily outflows to below $400 million as of today, as the initial wave of selling pressure seems to be winding down. Sellers right now are twofold: investors who have been trapped in a discounted vehicle and have waited for it to close to sell into cash, and investors who are selling GBTC for a vehicle that has a lower management fee. The former has created a headwind for bitcoin's price, while the ladder is price neutral for bitcoin as Grayscale sells spot bitcoin, and another entity buys an amount to offset it. When the former cohort of trapped investors dies down and GBTC's outflows are solely those who want the lower fee, these outflows will no longer be a negative force for bitcoin's price:

Here are the flows and volume for all 10 spot bitcoin ETFs since their launch/conversion. Grayscale continues to push down the net flows of all spot bitcoin ETFs, with only $744.56 million in net inflows after the massive $4.79 billion in outflows from GBTC alone. Ex. GBTC, net inflows total $5.53 billion:

In fact, we may already be at the stage where cohort #1, investors who have been trapped in a discounted vehicle, have fully sold their positions—or at least have mostly exited the market enough to be offset by cohort #2, and new buyers. Bitcoin managed to rebound some $3,000, now back above the $42,000 mark after falling all the way from $49,000 on the morning of the ETF launch. Post-ETF woes are subsiding for the industry leader, and its path is finally lining up with the market's upward trajectory:

Only 12% of bitcoin remains on exchanges, a massive reduction from the 18% of supply floating around on exchanges prior to the last bull market kicking off. Given how bitcoin's market capitalization has magnified fourfold since then, and institutional investors now have vehicles that will directly invest in spot bitcoin for them, it is all the more encouraging that fewer bitcoin sit on exchanges for them to bid up. Pair these supply dynamics and new investor cohort with market-wide risk sentiment and supportive bitcoin price action, and we're looking at clear skies ahead, with strong signs of an early bull market if the wider market can stay intact:

Peeking at equities to get a sense of how bullish conditions are, it is full steam ahead. This week alone, the SPX is up 51 points, the Nasdaq is up 12 points, and the Russell is up 36 points—it is highly encouraging that all major stock indices smashed past their all-time highs instead of hovering meekly around them or testing and failing to move above them. An assertive breakout like what we saw this week is a further indication that sentiment in the market is avowedly risk-on, perhaps too risk-on.

There are some foreboding signs across market commentary, particularly when it comes to the way pundits have started to value companies. It is beyond justification for stock prices to be where they are given interest rates are 525 basis points higher than they were 2 years ago—so much so that the "price to innovation" ratio, or P/I, has started cropping up on CNBC and Bloomberg as language used to value stocks.

In 2000, pricing internet stocks based on eyeballs and other arbitrary metrics such as "page views per quarter" and "stickiness" were used. From 1998 through to the dot-com bubble bursting, stock prices became outlandishly overvalued by traditional metrics, so pundits invented new ones, believing that valuation had fundamentally changed. It hadn't.

Arbitrary nonsense terms like these are less about valuing stocks like pundits claim and more about justifying the mania. Signposts and echoes of previous bubbles continue to pile up. Not necessarily a top signal, but a hallmark of a bull market and something to keep in mind as consumers and businesses get tested into Q2.

Only ~$290 billion in aggregate excess savings from post-COVID stimulus remain, down from $2.1 trillion at its peak and slated to run dry by March, which we covered on Monday.

On top of that, businesses in the US are facing a wall of debt maturity, where they will have to roll their maturing debt into new debt. It just so happens that as mentioned previously, interest rates are 525 basis points, or more, higher than they were just 2 years ago. A whopping $1.868 trillion of this debt is coming due this year, and businesses will not be able to fund new debt if they take on the same amount, meaning they will have to scale back their operations—hitting the labor market, slowing economic activity, and risking recession:

In the Fed's meeting on Wednesday, members will likely continue talking down elevated risk-taking to claw back some of its credibility while being mindful of the reality that eventually, financial conditions won't be as loose as they are now. Mindful of the approaching maturity wall for businesses and post-COVID consumer stimulus having almost run dry, a decline in economic activity is inevitable, so it is in the Fed's best interest to avoid overly hawkish language that risks sparking any undue panic. We'll see if they can thread that needle!

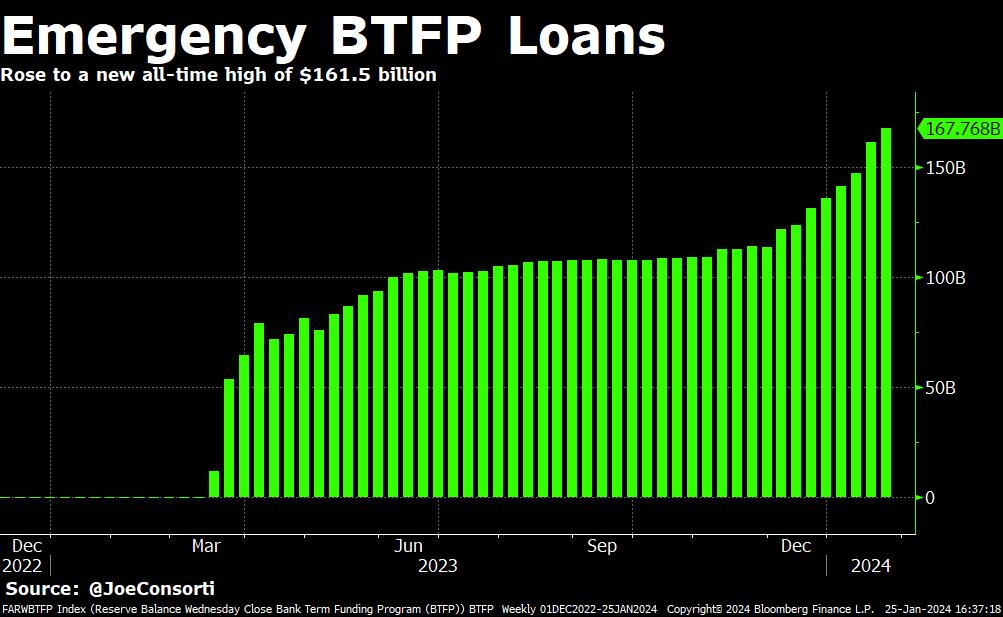

The Fed announced the end of its Bank Term Funding Program on March 11th, its original closing date when the program began last year. Loans from the program now total $167.8 billion, up $6.2 billion from last week:

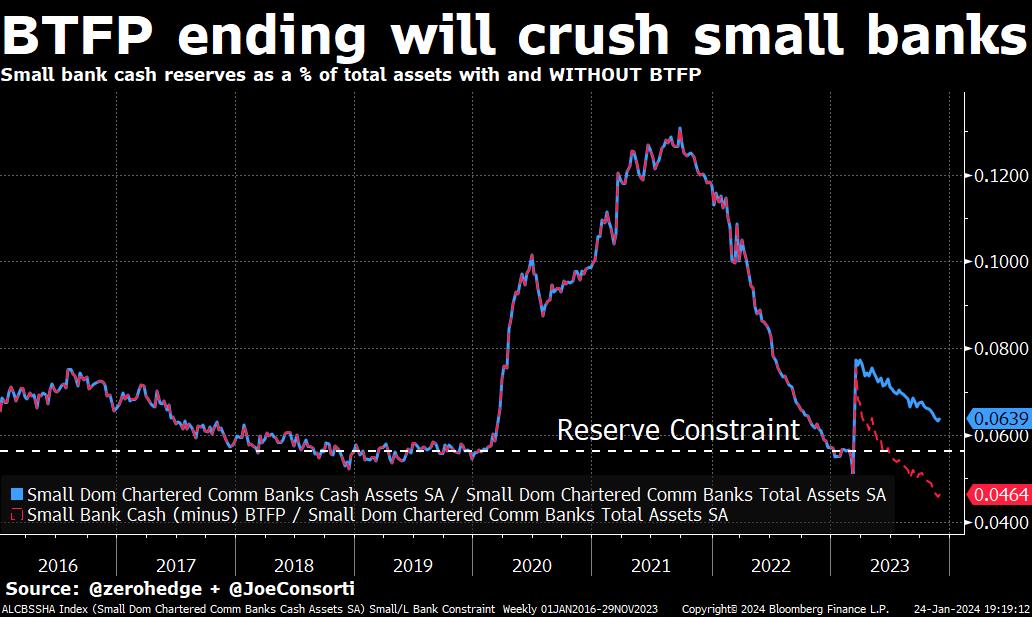

An extension was expected given how reliant banks are on it, particularly small and mid-size banks. Without BTFP to top up their cash reserves, small banks' reserve levels would already be constrained to the point that they start to fail. In a way, by not extending this facility, the Fed has signed the death warrant for mismanaged small and mid-size banks all across the US:

Not all outstanding loans will be called in 45 days from now, but no new loans can be extended past that date. Banks may even refinance debt until the last day of the program in March, with a maximum repayment time of one year—something that will likely cause cumulative loans to double as the closure date approaches.

While not an immediate death knell for small and mid-size banks, it will be another factor over the next 6-9 months as loans are called in and financial conditions tighten further as a result.

The Fed also killed the popular arbitrage trade of borrow-low at BTFP for 4.93% interest and lend/earn-high 5.40% on reserve balances. It announced that the interest rate on all new BTFP loans would be no lower than the interest rate on reserve balances. Reserve balances have been on the rise which has supported lending markets and allowed risk-taking, including stock prices, to rip. Reserve balances should begin to decline soon, putting yet another feather in the cap of tightening financial conditions:

The Fed is clearly preparing for the next crisis, any way you slice it. From forcing banks to tap the discount window, to allowing banks to extend their BTFP loans (where they remain anonymous) for yet another year, it is encouraging the proliferation of emergency loans, and with good reason.

Not only is the almost $2-trillion business maturity wall approaching, not only are consumers nearly depleted of their stimulus savings, but small banks are holding an increasingly worthless basket of loans from which they will fail.

66% of total commercial real estate loans are held by small and regional banks, and delinquencies on these loans are on the rise. According to Trepp, delinquencies for properties like lodging and office buildings are above 5%, up from 2.5% last year, and the average value of these properties has fallen 20-30%. The likelihood of repayment dwindles as vacancies on these buildings creep up and refinancing terms become tight, raising the odds that small banks are left holding a steaming pile of nothing when all is said and done.

The Fed allowing banks to refinance with BTFP is a tacit admission that low-risk, anonymous emergency loans are still required to keep small banks afloat. The Fed forcing otherwise healthy banks to tap its emergency loan program is further confirmation that not all players are ready for recession.

As our monetary leaders prepare for crisis and bitcoin finally regains its footing, developments at the US' southern border threaten to throw yet another wrench into the mix. 2024 is shaping up to be an exhilarating year in markets, for better or worse. Keep it here at Theya Research so you can find the signal through it all.

Have an excellent weekend everybody,

Joe Consorti

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Download Theya on the App Store and declare your sovereignty today.