The Fiscal Crosswind Has Made It Impossible For The Inflation Plane To Land

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it. Your Keys, Your Bitcoin.

Download Theya on the App Store and secure your bitcoin with ease.

Have you ever watched a plane come down for landing in the middle of a crosswind? Take a look at this video out of Madeira from this morning:

This video is perfectly analogous to the situation we're faced with today in markets. As the United States Treasury issues larger amounts of debt and the government intends to spend crisis-level money when we aren't experiencing a crisis, the level of spending makes it almost impossible for prices to normalize. Like a plane attempting to land amidst an extreme crosswind, the pilot has to commit to his descent fully in order to ensure the plane lands safely rather than crashing.

Analysts' expectations for inflation have been persistently wrong for several months straight. Expectations as of June 2023 were an average of half a percent lower than what we ended up getting in the 8 months since:

Prices have risen faster than analyst expectations for nearly a year now. Why hasn't it been able to descend back to the 2% target, having achieved such steady progress from 9.1% down to the 3% range? Fiscal spending.

The US Treasury is ramping up its borrowing and the government is raising its projected annual budget for the next fiscal year at the same time that the Fed is raising its policy interest rates to tighten credit conditions to slow spending and bring down the rate of price increases.

In this contradictory war of loosening and restricting, the magnitude of the Treasuries borrowing has won out, spending into the real economy faster than the Fed has managed to coax economic spending to slow.

The Biden Administration published a $7.3 trillion budget for FY 2025, a whopping $0.9 trillion higher than what we're spending this year. This is indefensible, reckless spending. Crisis-level spending that you'd see following a sudden recession or the pandemic lockdowns, yet we don't have a crisis. This will only widen the deficit further, reaching -10% as soon as mid-way through next year if tax receipts disappoint and the difference is picked up by more US debt issuance:

Where has this left the US consumer? In shambles. The net effect of Treasury spending while the Fed raises rates is prices remain elevated and rising quickly while interest payments on debt servicing for households have never been higher. Net net, consumers are shafted with both prices and interest payments.

To cope with the higher prices and debt service costs, Americans are piling into credit card debt they can't pay down to outrun price inflation. It took 18 years for US credit card debt to rise by $355 billion, from 2002 to 2020, and it has taken just 3 years to rise another $355 billion. This is unsustainable, and no amount of misleading econometrics will convince the American voter otherwise:

Interest payments as a % of household income have risen faster than any previous cycle, from a record-low of 1.1% to 2.42% on par with previous cycle peaks in this metric just before recession. Look at that slope, it's truly staggering:

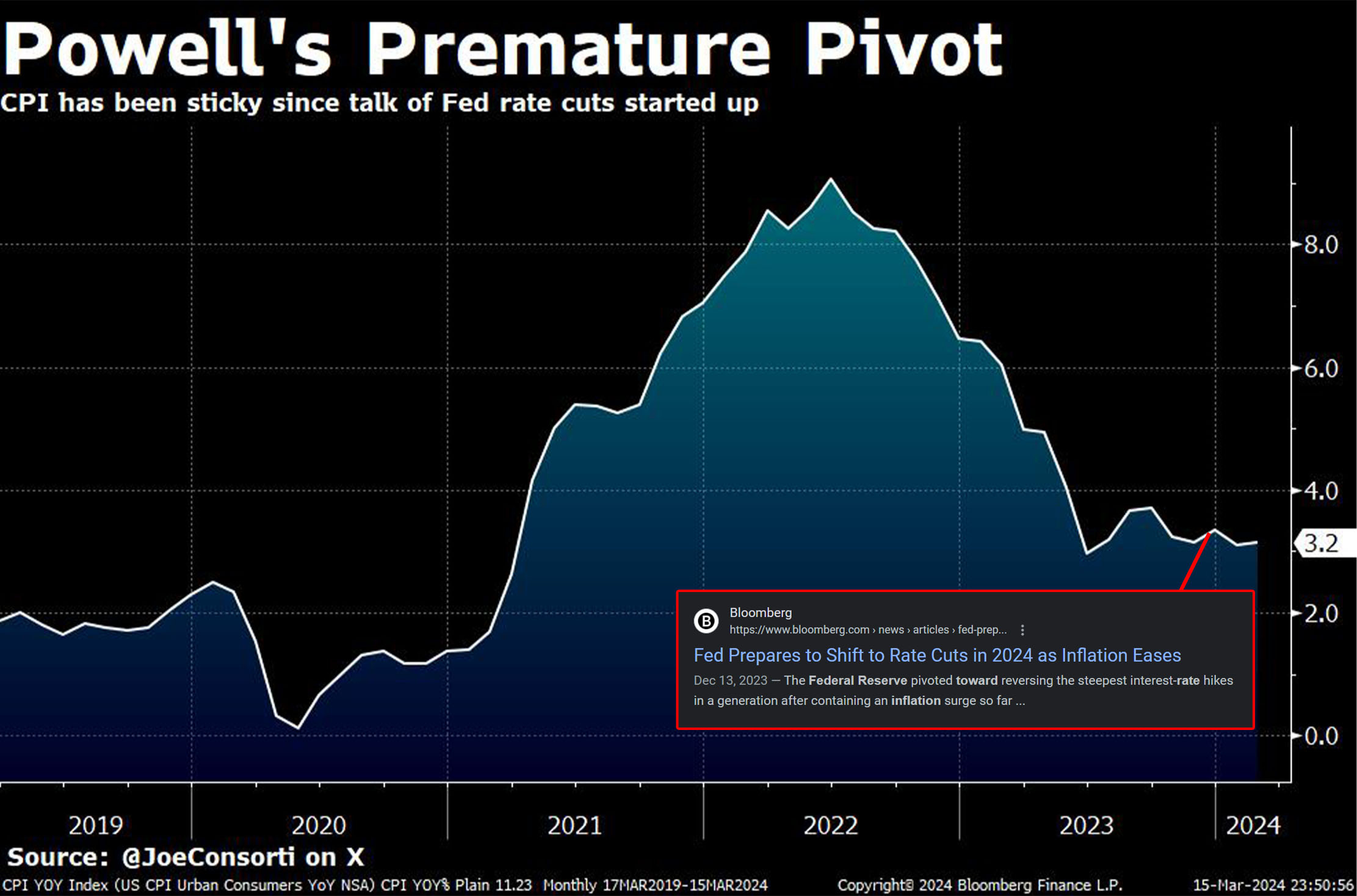

CPI has been above the Fed's rough target range around 2% for 9 months in a row, and it's all Powell's fault. His Fed discussed rate cuts before price inflation arrived at the aforementioned 2% target. They did this to preempt the market and minimize the risk of deflation, but ended up causing the descent of CPI inflation to stop dead in its tracks for 9 months, where it has not moved since:

Worse yet, consumers don't expect price inflation to normalize any time soon. Inflation expectations for one year ahead are still out of control by the Fed's perspective, at 3.04% instead of the Fed's (arbitrary) target of 2%:

Credit contraction in the US has been shallow and is about to flip to a credit expansion after just ~8 months. Huge spending from the US Treasury has loosened credit as the Fed has been trying to tighten it. 3% annual price inflation is here to stay if they don't get on the same page soon:

And herein lies the catastrophic error that will ensure price inflation does not come down to 2%: Jerome Powell is still expected to discuss rate cuts this Wednesday instead of being steadfast about his inflation target. Instead of the Fed and Treasury coming to an agreement to reign in spending and keep rates high to bring inflation down, the Fed is relenting more in the loose direction that our fiscal policy has taken.

Why?

- It is an election year—government spending rises during election years as the incumbent administration seeks to cushion the economy and spend money on their constituents needs in a bid for last-minute votes.

- The Fed needs to cut rates so banks become profitable again.

The yield curve has been inverted for two full years, meaning that short-term interest rates have been higher than long-term interest rates along the US Treasury curve. Banks, who are in the business of borrowing short and lending long, go underwater when they are borrowing at a higher rate than they can lend or invest. As such, the Fed is expected to deliver news of rate cuts this Wednesday to support the banks, to the detriment of prices which stand to continue rising quickly:

The market-implied odds of a rate cut by June are currently at 52%. All eyes will be on Wednesday's FOMC meeting to see if Powell suggests they will come sooner or later than the market expects, and how many we will receive in 2024:

If cuts happen, price inflation will continue hurting Americans. If rates stay where they are, recession risks are elevated and the stock market is in jeopardy, which is the last card for the Biden administration to play. Powell needs to be an expert pilot to land this plane correctly without inadvertently crashing it, and it looks like he'll be erring on the side of keeping price inflation hot for the foreseeable future.

An inflation reacceleration is in the cards, or at the very least, the 3% long-run annualized rate is here to stay. A deliberate hollowing out of the American middle class is underway, buy bitcoin to insulate yourself from it, as it is the apex asset for appreciating in the face of perpetual monetary debasement.

Final thought: it has long been said that gasoline loses elections, and gasoline prices are on the move once again, up 36 cents YTD to September levels.

Take it easy,

Joe Consorti

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it. Your Keys, Your Bitcoin.

Download Theya on the App Store and secure your bitcoin with ease.