Recession Unlikely In 2024, At The Cost Of More Inflation

Theya is an app for simplified Bitcoin self-custody. With our Modular Multisig solution for self-custody, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store and secure your bitcoin with ease.

The inflation-recession tradeoff has never been more polarized.

Since it is an election year, the US Treasury will simply not allow a recession to take place—the timing couldn't be worse, because the Fed is trying to slow down the economy, bringing down spending, and price inflation alongside it. With the government and Fed at odds with one another, the US Treasury's crisis-level spending has clearly won out when observing the headline economic data: price pressures have come back.

The ISM Manufacturing report came in yesterday morning. It takes survey data from upstream manufacturers and turns it into an index, based on whether manufacturing conditions were better or worse than the month prior.

It is now above the 50 expansion-contraction threshold for the first time in 17 months. The probability of recession in 2024 is low if this trend can remain intact. See the chart below, where year-over-year GDP growth follows the path of ISM manufacturing with a 6-month lag:

The survey has 3 separate components: prices paid, employment, and new orders. Employment is the only component still in the below-50 recession zone, as both new orders and business prices paid rose last month and are well above 50. Prices paid is leading the charge at a value of 55.8, it is now at its highest level in the past 22 months:

This re-acceleration in prices paid by manufacturers lines up with the spike in personal spending and PCE that I discussed in last Friday's post.

If you're enjoying today's post, don't forget to subscribe! It's free.

JOLTS job openings rose marginally this month from 8.74 million to 8.75 million, largely in line with the employment component of the ISM survey that is still limping along. There's a pretty big asterisk here, though.

Job openings in the US for the previous month were just revised down by 115,000 jobs. 12 of the last 14 job openings reports have been revised lower after the fact. Once or twice is circumstantial, but the frequency of wild overestimation followed by downward revision is a clear pattern. Economists in D.C. project strength in the initial headline, then quietly revise it lower a month later:

Employment may have stagnated but price inputs are still stubborn and notching higher, at least in manufacturing. This is the worst kind of combination. Only a recession would correct this and bring prices in line with employment, but there's no chance that a recession will be allowed to happen in an election year.

The Fed's monetary policy is counter-cyclical, meaning when the economy is hot the Fed tries to cool it by raising its policy interest rates and shrinking its balance sheet. Data has been moderately stable with glimpses of outright strength, so rate cuts simply don't make sense right now, and Chair Powell finally said as much last Friday, saying, “we don’t need to be in a hurry to cut.”

Yesterday and today's data drove projected rate cuts to shrink in size and get pushed further back in time. Odds of a rate cut in June have gone from an absolute certainty to basically a coin toss. There is now a measly 62.8% chance that the Fed hikes one time in June in its tiniest increment of 25 basis points—a far cry from the 75-bps of cuts priced in for June back in January:

Treasury yields responded the same way in response to the hot ISM print and stable JOLTS data. The 2-year UST yield, a proxy for Fed rate expectations, dropped 4 bps, while the 10-year, a proxy for growth expectations, fell 5 bps:

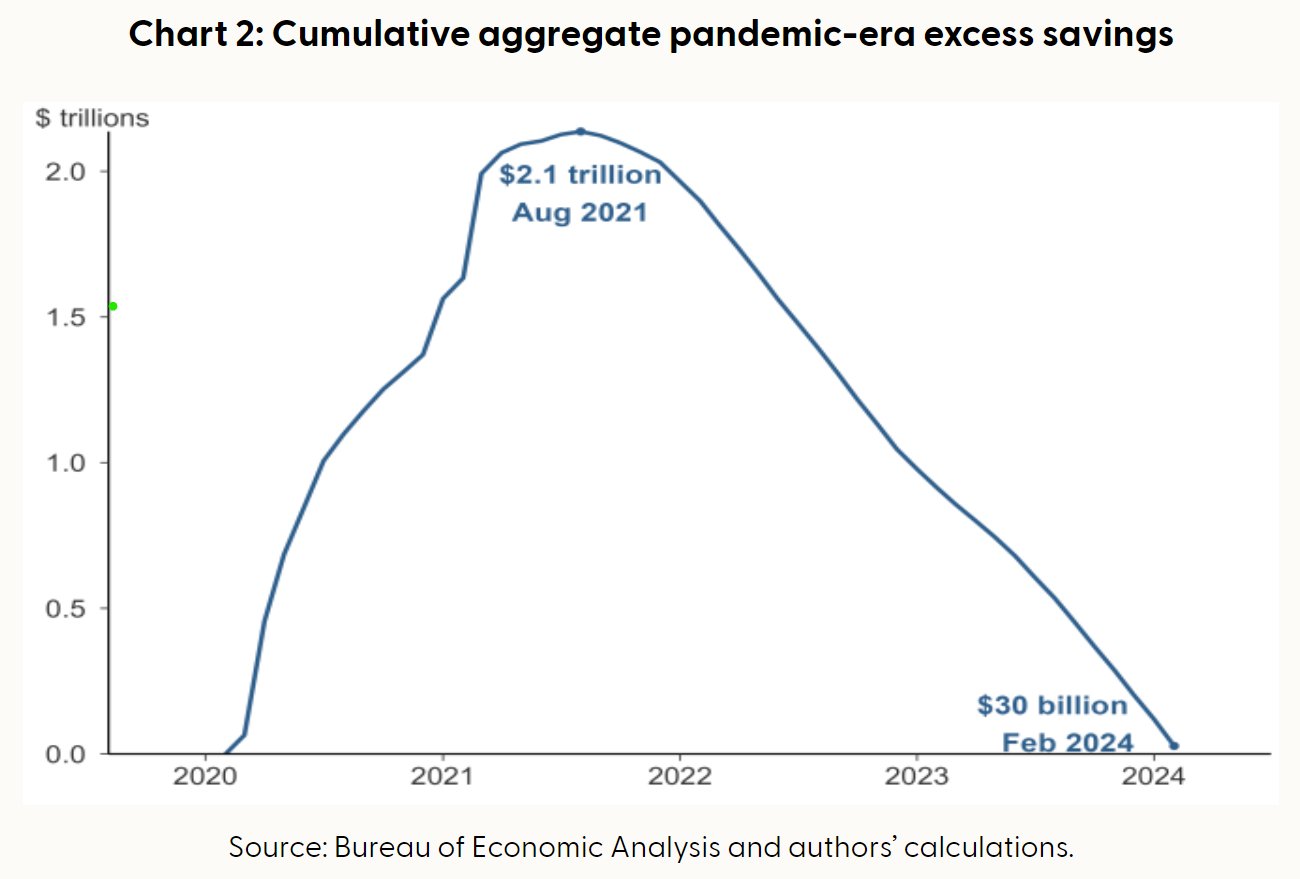

Hot price inflation with disappointing economic growth is an awful spot for the Fed to be in. Two things on the horizon that may change this are tax day in 2 weeks, and consumers running out of the pandemic-era excess savings. Both of these are disinflationary and could bring hot inflation in line with paltry economic growth, giving the Fed reason to cut rates. Pandemic-era excess savings total $27.3 billion—down $92 billion from last month:

A few weeks ago I talked about the Fed's challenging descent as it tries to land the economic airplane. We are locked in a spot where the US Treasury's spending has totally negated the Fed's efforts in fighting inflation, but it hasn't helped employment which is starting to really lag behind. Stagflation is not the spot that any incumbent Presidential candidate wants to be in. As we approach November, it will continue to erode the incumbent's chances at re-election.

Final thought: history is never kind to fence-sitters, Chair Powell.

Take it easy,

Joe Consorti

Sign up for Theya Research

Bitcoin analysis, research, and market reports.

No spam. Unsubscribe anytime.

Theya is an app for simplified Bitcoin self-custody. With our Modular Multisig solution for self-custody, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store and secure your bitcoin with ease.