Labor Market Propaganda Is Getting Worse, But The Market Isn't Buying It

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Your Keys, Your Bitcoin.

Download Theya on the App Store and secure your bitcoin with ease.

Today's labor market data is, at first glance, relatively strong, with February's nonfarm payrolls report showing that 275,000 jobs were added last month, had the only sour note being the unemployment rate that is finally showing continued weakness by rising to 3.9% from 3.7%. Looking closer, the United States' labor market is quickly veering off of the track, and headline data releases are doing their best job at concealing this fact.

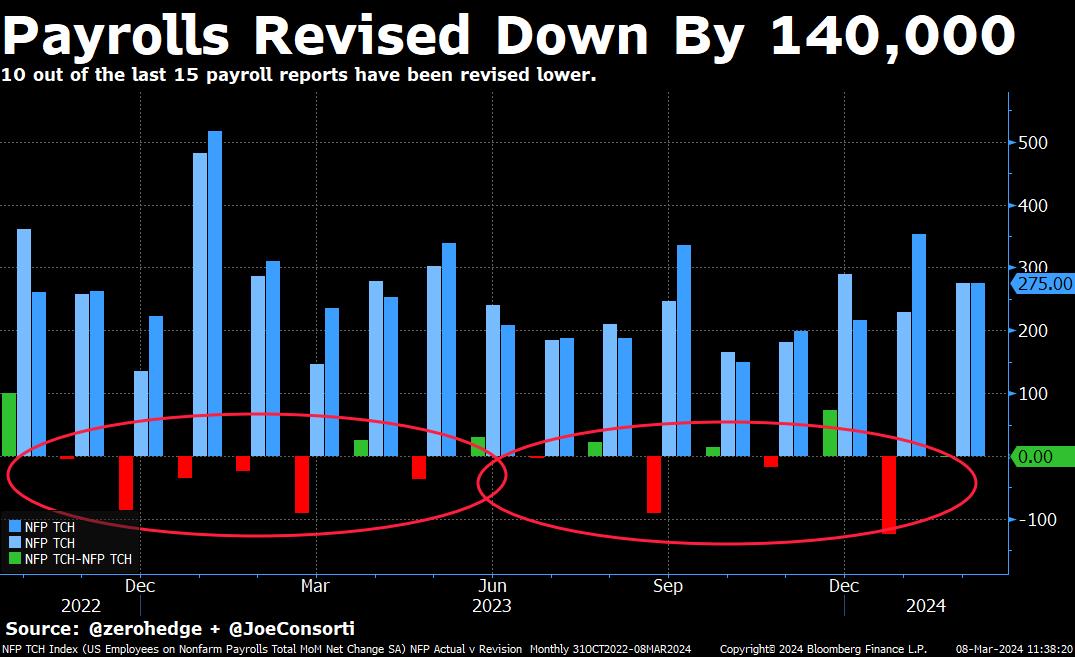

Revisions that come one month after nonfarm payroll data are far more telling than the data we receive for the month just passed. Why? 10 of the last 15 months' payroll reports have been revised down after the fact, with last month's release being no exception.

January's nonfarm payrolls report showed 353,000 jobs added, but that was revised down to 229,000 today, an absolutely insane 124,000 fewer jobs than were initially reported, marking a 35% overestimation. The frequency and size of these errors, in addition to the fact that there are never underestimations of payroll gains that are similar in size to these overestimations, tell me that this is completely intentional, a propaganda tool of the highest order.

When news chyrons flash about the astounding, record-shattering job growth in January, that is great for the incumbent administration in Washington D.C.—it doesn't matter if none of it is true, because when the revision comes the following month, it doesn't make a single headline. Fudging data to pontificate strength while quietly revising the following month with the real data they've likely been harboring all along.

They hope you don't notice, but of course you do, because you feel it. This tool has become less effective as the cycle has worn on and more people feel how bad the labor market is relative to how glowingly the media is reporting about it:

The rot in the American jobs market goes deeper than fudged job additions. Total nonfarm payrolls rose 275k to 157.8 million, but the household employment survey, which actually captures the number of people employed, dropped by 184k as Americans have increasingly been taking on multiple jobs to get by. All told, 921,000 part-time jobs were gained since this time last year and 284,000 full-time jobs were lost.

The number of people employed in the US is now at 153.9 million, which is the lowest it has been since May 2023, making the divergence between jobs and people employed a whopping 3.83 million. By other measures, as many as 8 million people are in two or more jobs, more than double the historical average level.

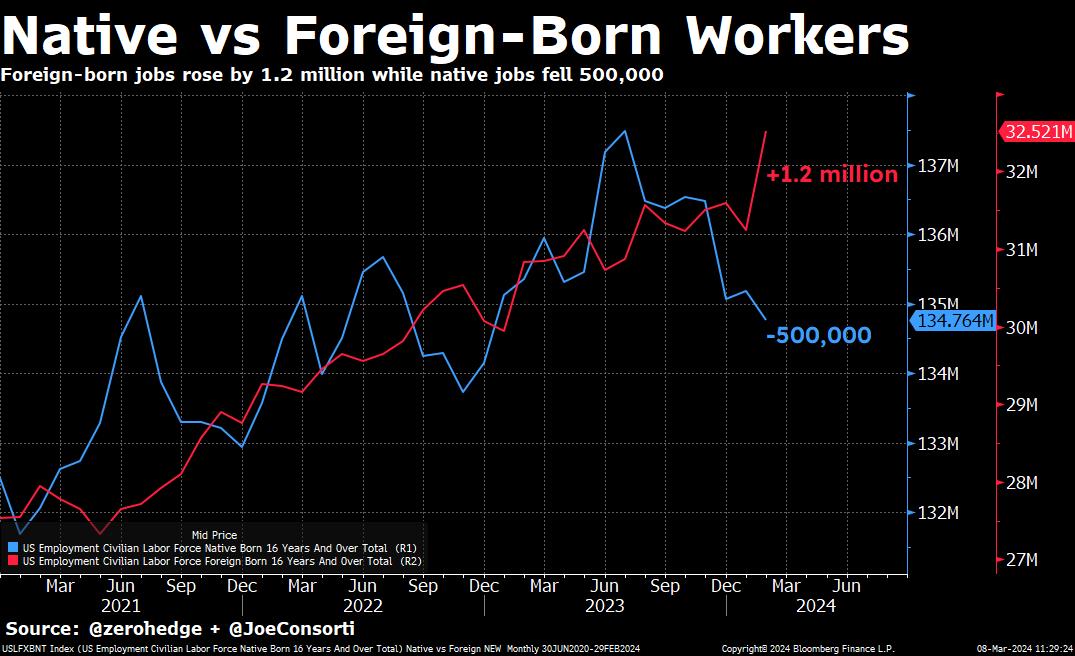

The labor market has been booming for one particular cohort of people, those being immigrants. Foreign-born jobs rose by 1.2 million in February, an all-time record, while jobs for native-born workers fell by 500,000.

Zooming further out, roughly 2.4 million native-born jobs have been lost in the past three months. Between this surge in migrant work and the surge in part-time employment relative to full-time work, it is no exaggeration to call this an economic expansion of part-time migrant Uber drivers:

Not to mention, job growth for native-born Americans has been flat for 6 years, since May 2018. On net all ~3.9 million job gains have gone to foreign-born workers, both legal and illegal. This explains the growing resentment among the American middle class toward the incumbent Presidential administration, as immigration has subsumed inflation as the key issue on voters' minds for the longest continuous period in decades, perhaps ever:

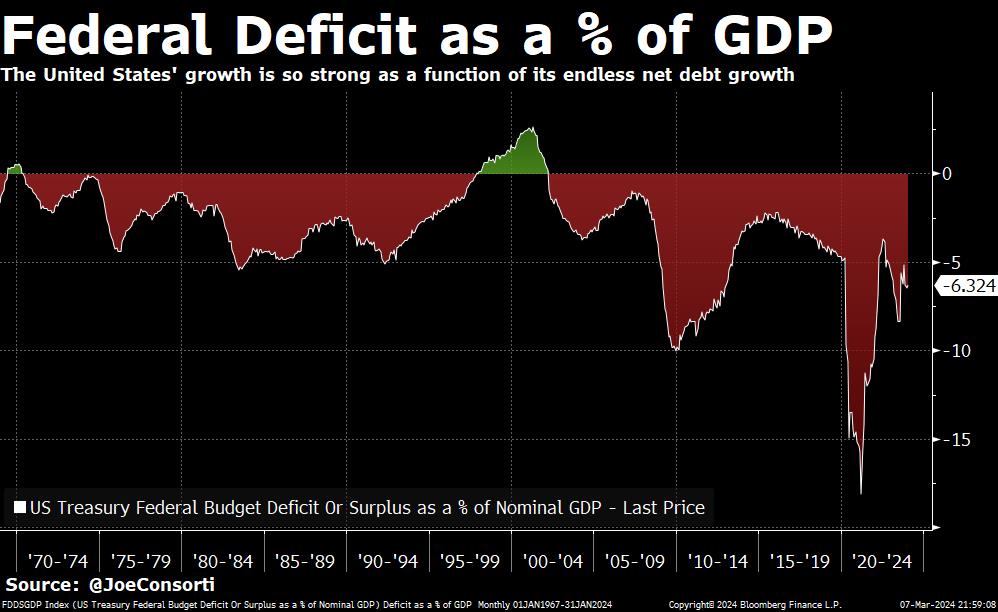

This follows last night's State of the Union address, where President Biden said he brought down the deficit, a complete fiction looking at the chart of our deficit, which has continued its multi-decade decline as a percentage of GDP. Truth no longer matters, this is made increasingly clear as neither the BLS nor the highest office in the land care about telling it time after time:

The good news is that the market is not having it anymore, and US Treasury rates tell us just that. Rates give us the most signal about marketwide sentiment, given how actively traded, liquid, and integral to global financial plumbing they are. How is the market positioning itself given the totality of today's data? They view an economic slowdown on the horizon, and the 10-year yield has traded down from a high 5% in September to 4% today, with the 2-year yield making a similar downward move as traders expect rate cuts in response to the slowdown:

The labor market is slowly but surely coming off the rails after months of lag between the Fed's hikes actually showing up in financial tightness and subsequent layoffs/hiring slowdowns. The unemployment rate is continuing to come off of its lows, hitting a 2-year high of 3.9%:

The labor market unwind is beginning in earnest. The share of US workers unemployed for 15-26 weeks is a time-tested indicator for recession timing, as every time it has risen consistently, a recession has soon followed. By this measure, it looks increasingly likely that the labor market has passed the point of no return:

That said, markets are poised to continue ripping, with no imminent danger thanks to strong corporate fundamentals, consistently good earnings, and corporate credit that hasn't yet tightened significantly thanks to low-rate debt locked in until the majority of corporate maturities hit at the end of this year and into next.

Final thought: Coinbase has gone down both times that bitcoin has wicked up to a new all-time high this week... might be time to download Theya and self-custody.

Take it easy,

Joe Consorti

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Your Keys, Your Bitcoin.

Download Theya on the App Store and secure your bitcoin with ease.