Bitcoin Threatens All-Time Highs As ETF Inflows Accelerate

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Download Theya on the App Store and declare your sovereignty today.

Bitcoin continues gunning for all-time highs off the back of record-breaking volume this week across its suite of spot ETF products. Institutional interest is ramping up as the weeks go by, with retail traders jumping in to not miss out on the potential massive price appreciation waiting in the wings. This feedback loop has taken bitcoin from ~$40,000 in January to $50,000 last week, rocketing up as high as $64,000 this week and threatening new all-time highs above $69,000:

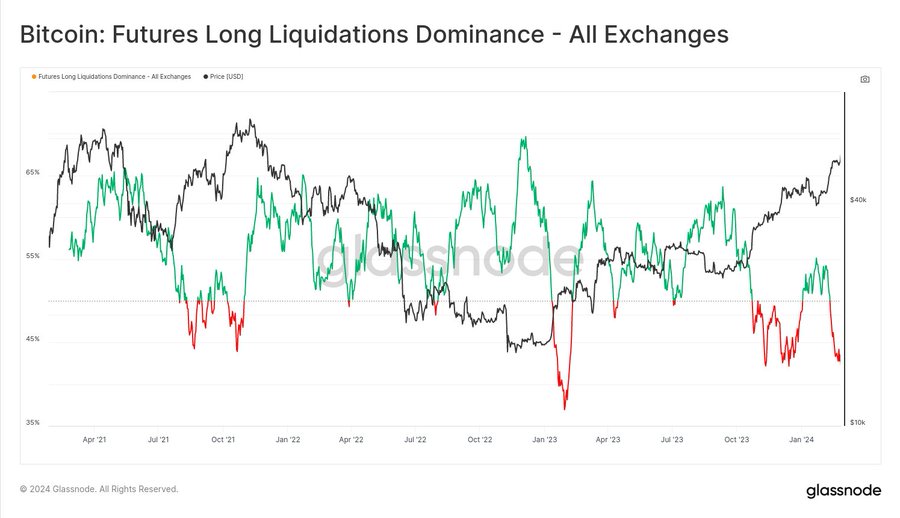

Better yet, bitcoin is on much stronger footing than last time around this price level. Last time, the market was dominated by leverage and very little spot-buying. Like building a beautiful oceanfront cliffside property on stilts rather than building directly into the cliffside or better yet, further inland, the Foundation is key to bitcoin's stability and staying power too. Note the aggressive liquidations in the run from $10,000 to all-time highs around $70,000 last time around compared to the comparatively muted liquidations this time around on both the long and short side. People are buying and holding spot bitcoin, a much firmer foundation than buying and selling with 100x leverage. Huge price swings to one side or the other are a thing of the past:

This futures market structure is one of the key differentiators between 2024 and 2021. In 2021, the market was dominated by long positions that created lopsided selling pressure when the market moved against them. Now the market is dominated by shorts who are creating lopsided buying pressure when the market moves against them. Said differently: the leverage baked into bitcoin’s current market structure won’t make for liquidation cascades, only cascading buy orders, a huge tailwind that only adds to a favorable macro backdrop, ETF inflows ramping up, and the forthcoming halving as factors that are in bitcoin’s corner to go well beyond the 2021 cycle top:

Wednesday was the busiest day for the 10 spot bitcoin ETFs yet, clocking in a record $7.69 billion in buy/sell volume. It has since tapered off to close the week:

Of the ~$100 billion that went into bitcoin on Wednesday, less than 1% of that came from ETF inflows, which clocked roughly ~$750 million in inflows. The explanation for this, as stated previously, is retail flooding the market in anticipation of institutional flows. This ostensibly creates a positive feedback loop where more capital on the ETF side grows interested, increasingly bidding up the products, driving further retail FOMO. All told, a perpetual motion machine between Wall Street and Main Street is underway, all driving daily bitcoin bidding higher and higher:

The scale of Wall Street's entry into spot bitcoin needs to be appreciated. The 10 spot bitcoin ETF firms have a combined AUM of $18.4 trillion and barely $40 billion (0.21%) of it is currently in the spot bitcoin products. As bitcoin's outperformance persists and interest in the asset follows suit, a migration of capital out of other products and into the bitcoin products is inevitable. More banks are seeing huge dollar signs in their eyes and are jumping on the bandwagon to scoop up fees as these products prove to be the most popular on offer at the current 10 firms that carry them. Merrill Lynch and Wells Fargo are now offering spot ETFs to their clients, and many more, representing trillions of dollars in total client assets, will follow suit:

All of this mania has happened within just two months and we are still weeks away from bitcoin's halving. That was the event around which most thought bitcoin's price would springboard, and bitcoin is already springboarding before it has even come about. Bitcoin has historically experienced gains by several-hundred percent in the year following each of its 3 previous halvings. With this in mind, six-figure bitcoin is closer than you may think:

The Fed also has yet to cut rates. These two tailwinds haven't kicked in and bitcoin is already challenging previous all-time highs and will likely set a new one in the days to come. We are currently in the midst of a Fed-pause rally—the last time we were here, bitcoin rose from sub-$4,000 to more than $10,000. This time around, bitcoin has already doubled from $30,000 to $60,000+ and the Fed has reiterated it doesn't intend to cut anytime soon thanks to a robust economy. The Fed cuts rates in response to economic calamity—during this on-hold period, ceteris paribus, bitcoin stands to run much further:

Lining up the dates that gold and bitcoin ETFs first launched, bitcoin effortlessly clears $300,000.This is without factoring in BTC's absolute scarcity, nor the rapidly deteriorating US fiscal outlook that necessitates an acceleration in monetary debasement. Add a few zeros and remove a few decades that it will take to get there, and you have a more accurate preview of the mind-shattering gains bitcoin stands to make in the years to come thanks to the combination of absolute scarcity in the face of unending monetary debasement and a hungry Wall Street:

Final thought: bitcoin is already at a new all-time high when denominated in the world's largest risk-free asset. Imagine that!

Take it easy,

Joe Consorti

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Download Theya on the App Store and declare your sovereignty today.