Bitcoin Enrages The Elite As It Gains More High-Profile Support

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Download Theya on the App Store and declare your sovereignty today.

This week was chock-full of disingenuous takedowns of bitcoin alongside some defense from high-profile individuals. As per usual, the attack efforts were full of lies and incomplete information. Andrew Ross Sorkin was the first to criticize bitcoin with the played-out and deceitful talking point that bitcoin is used solely by criminals, also attacking it with perhaps the dumbest statement of all time, "if it was a store of value, it would stay one price.” Take a listen:

Of course, a store of value is any asset that preserves your purchasing power, something that the US dollar has not done since the founding of the Federal Reserve in 1913 which explicitly targets 2% yearly devaluation as a policy directive. Sorkin, an award-winning financial journalist, knows this full well, and is lying to the face of CNBC viewers as the network flails for viewership and the ruling elite are floundering for cannon fodder against the one asset people are flocking into to insulate themselves from this perpetual theft of their livelihood.

He has taken the side of Gary Gensler lately, however inaccurate and slanderous it might be, who is on his own diatribe against bitcoin after having to reluctantly approve 11 spot bitcoin ETFs for trading in the United States.

Squawk Box host Joe Kernan, who is opposite Sorkin on this show, defended bitcoin with ease and correctly points out that people are using it expressly because it stores their value against the US dollar which does not. This is Joe Kernan's second time going to bat for bitcoin against unfounded claims recently. Just last week, he took down Gary Gensler who also tried to paint bitcoin as nothing but a hotbed for criminality.

Also speaking about bitcoin this week was President Donald Trump, who stated that he was indifferent to bitcoin and does not view it in direct competition to the dollar. This is the correct point of view, and one that I have been explaining for a while now.

Bitcoin and the dollar are complementary to each other. The dollar is the world's largest capital market and underpins the world's financial system, it is also the single most important financial onramp for people to buy bitcoin and hold it in their own custody. Bitcoin is far from having the infrastructure needed to displace the vast network of US dollar capital markets. In the interim, it also serves as a reminder to those in charge of monetary and fiscal policy just how badly they are doing, and a constant reminder that if austerity does not make a return, more people are going to be fleeing for the exits. Watch Trump's brief remarks here:

Bitcoin's perception is being ameliorated in the public sphere thanks to these key individuals and more. The trend of senselessly bashing bitcoin is waning, it is now more fashionable to champion it. Why?

Amidst the widest fiscal deficit the United States has ever experienced and price inflation roaring at a pace not experienced in decades, the calls for fiscal and monetary responsibility have never been louder. Bitcoin is the apex vehicle for the everyman to insulate themselves from it, offering superior risk-adjusted returns and serving as a commodity that has no central governing authority, low-threat of seizure, and can be owned outright.

It is foolish to denounce bitcoin at this stage in its life, where it is on an accelerating path to maturity coinciding with the ruling elite's accelerating path to global monetary destruction. The reputational risk associated with promoting bitcoin has is being displaced with the reputational risk of sitting idly by as Western governments become increasingly disinterested in working for the people they are meant to serve.

The elites, however, are less keen on legitimizing bitcoin, continuing to subvert and undermine it at every chance they get. Chief among them is the European Union, which released yet another blog post this week that says "bitcoin is not a suitable means of payment or investment"

This is the ECB's second major takedown piece on bitcoin in as many years. In 2022 the ECB published 'Bitcoin's last stand', where it made the claim that bitcoin had failed. The publication of this blog coincided down to the week with bitcoin hitting its absolute cycle bottom—great timing, Christine!

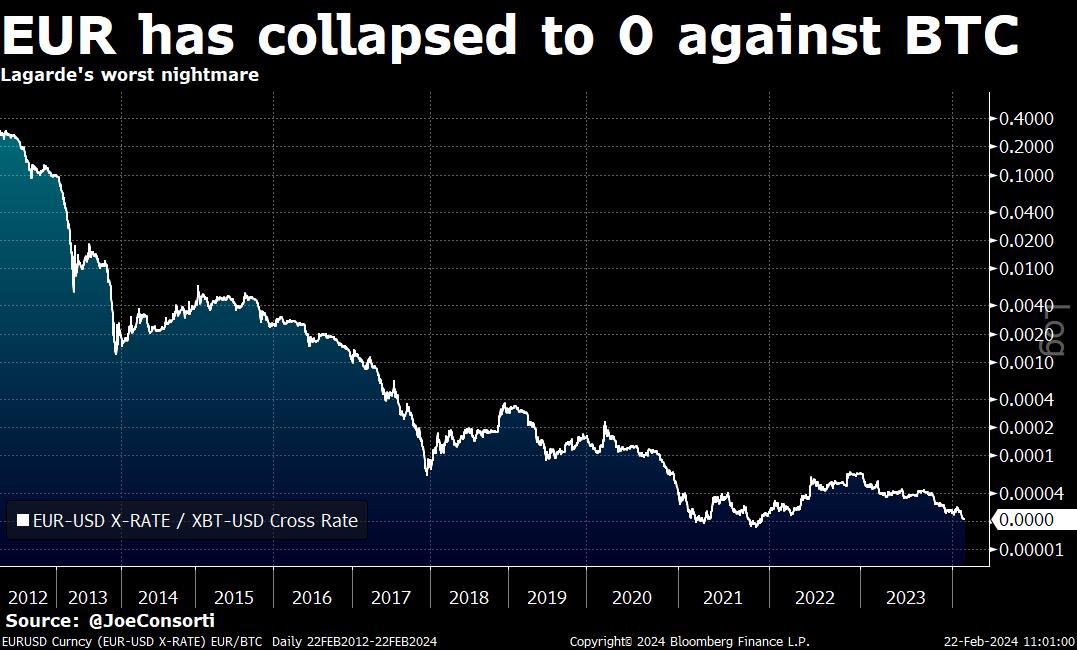

Now that bitcoin is soaring to all-time highs and has a suite of ETFs behind it, they're still making the same argument that bitcoin is on its way to failure that they made when it was at its cycle low. They call transactions slow and costly, demonize proof of work for its energy expenditure, and most laughably call it an unsuitable investment. All of these critiques are disingenuous when you understand that global central banks are not working for you, they are working to enrich themselves while functionally enslaving you through artificially manipulating interest rates to create the boom and bust cycle, while devaluing the money through loose fiscal and monetary policy. With these goals in mind, accuracy is not their priority, deception is. In the mind of Christine Lagarde, who wants to maintain the illusion that the ECB is working for the European people, this is what a suitable investment looks like:

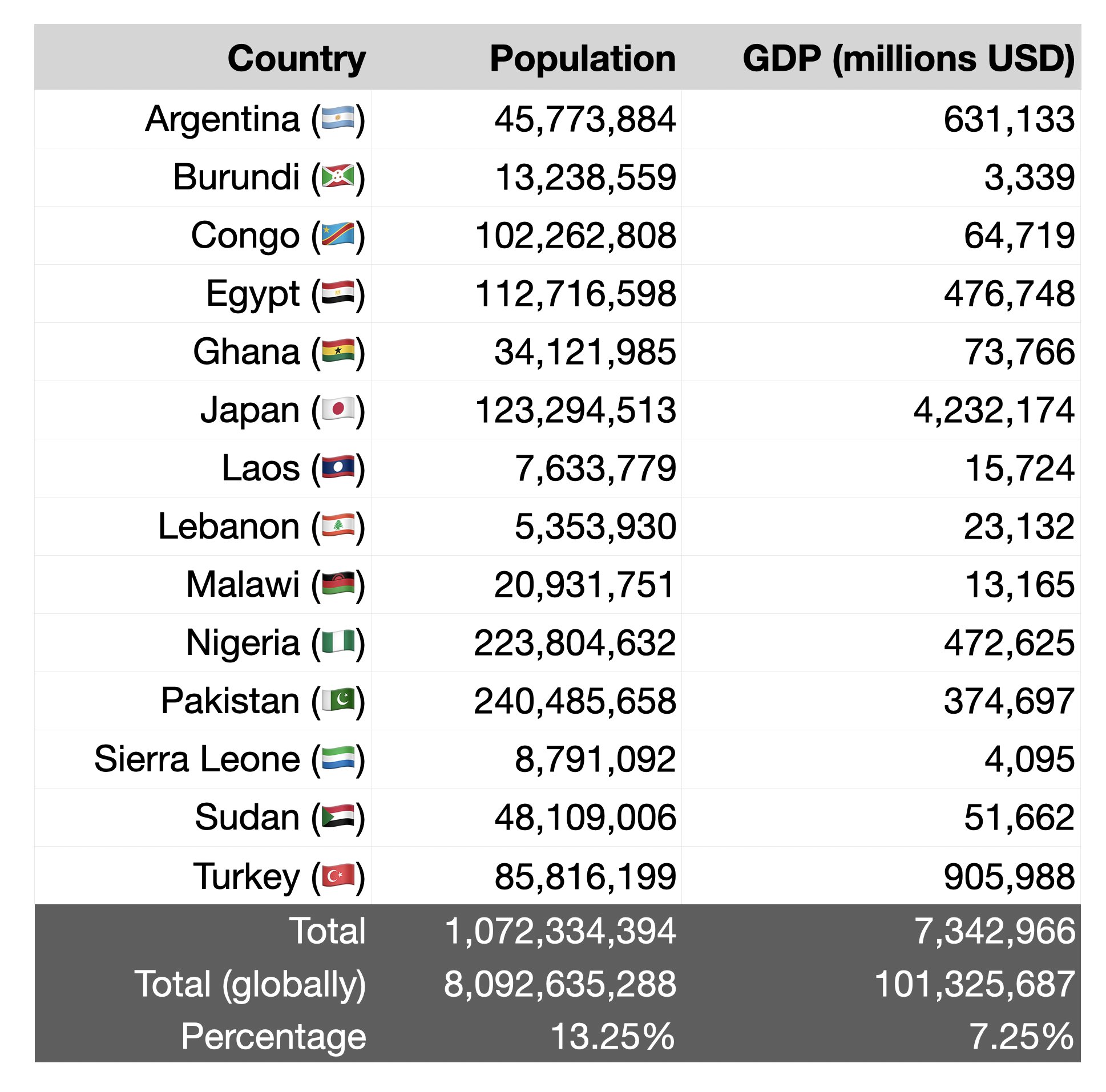

In non-Western countries that have much less liquid currencies, the devaluation is even more accentuated. Bitcoin has passed all-time highs in fourteen countries:

Bitcoin denominated in long-end US Treasuries is also at an all-time high. It joins the likes of these 14 different highly illiquid and horribly mismanaged global currencies that are rapidly depreciating against BTC as people divest from them. Coming off the back of the fastest rate-hiking cycle in history, the asset previously demarcated as risk-free, the US Treasury bond, experienced the sharpest fall in total return in its history.

Bitcoin enrages the monetary elite because it holds a mirror up to their policy, a constant reminder of the damage they wreak, and a warning that if they don't return to working for the people, the people will continue divesting and making their policy tools even less effective:

To round out the week, brand-new emails from Satoshi Nakamoto were unveiled in court documents. I'd recommend reading through them if you have some time.

Final thought: Craig Wright is still not Satoshi.

In Novemeber 2023, Craig Wright tried to make a version of the Bitcoin whitepaper in Latex. The below animation shows Craig graudually editing the file, to try to make the formatting match that of the real Bitcoin whitepaper, which was made with Open Office pic.twitter.com/804qzXfSAj

— BitMEX Research (@BitMEXResearch) February 23, 2024

Take it easy,

Joe Consorti

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Download Theya on the App Store and declare your sovereignty today.