2024 Is Shaping Up to Be a Bitcoin Election

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.

the cliff-notes:

- young voters are shifting from Democrat to Republican in droves

- the shift is explained by discontent with the decay of the country and a hunger for a return to tradition, populism, and national identity

- part of this decay is the wealth problem, which is why young voters get behind bitcoin

In 2024, young voters are shifting right, and Bitcoin's role in the November presidential election has taken center stage as one of the key reasons why.

Recent polling shows a generational shift. For the first time in decades, young voters—Millennials and Gen Z—are warming to the GOP. Former President Donald Trump leads President Joe Biden among younger voters in some polls, defying historical trends. This isn't just a flash in the pan; it's a seismic shift. In 2020, 42% of young men (18-29) were Democrats and 20% were Republicans. Today, 32% are Democrats and 29% are Republicans. The Democrat share of the youth vote went from a 200% lead to a margin of error in less than half a decade:

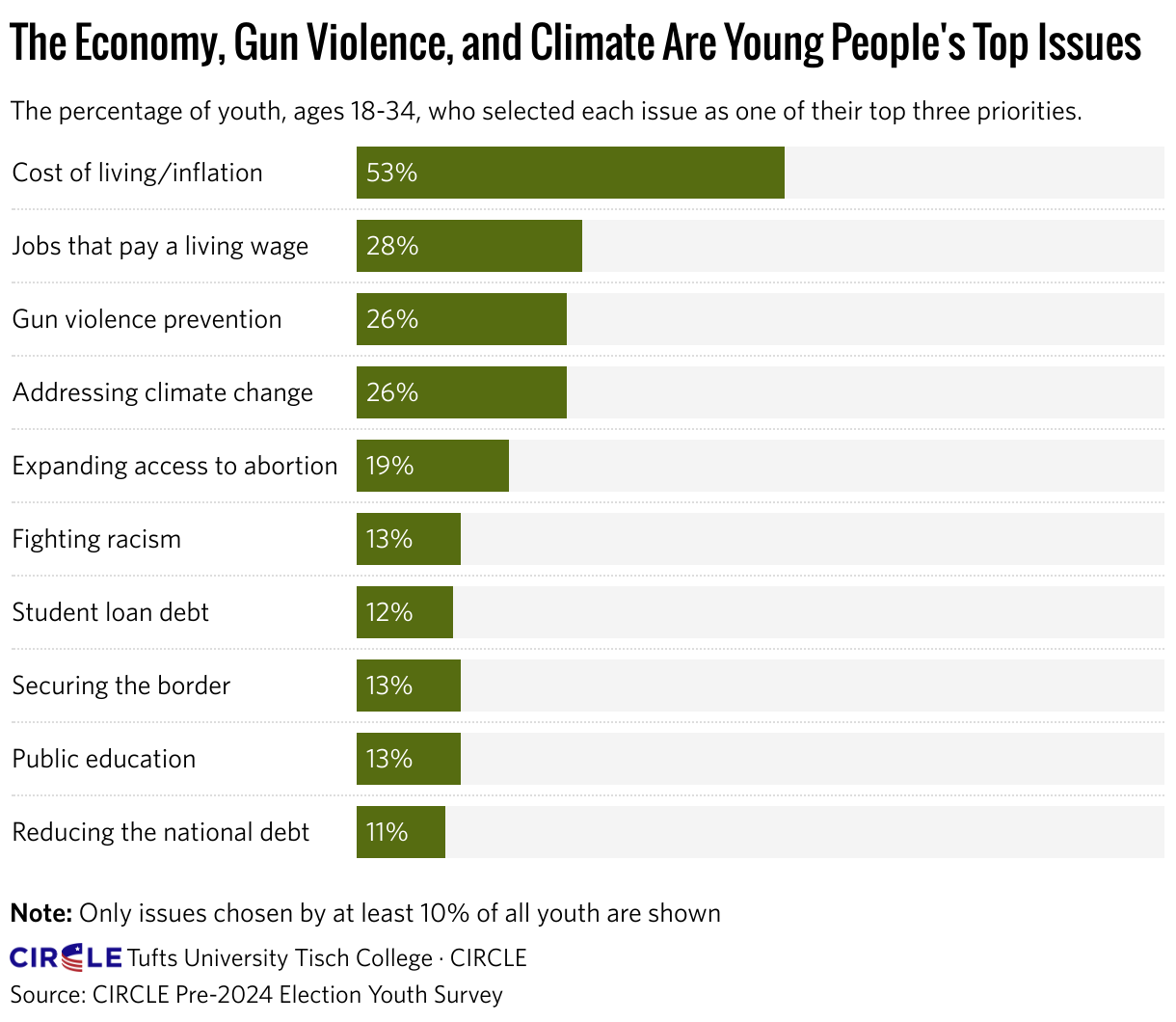

What matters to this rising electorate? Their financial situation. Call it the cost of living, jobs that pay a "living" wage, student loan debt, asset prices, or inflation, it all stems from the same underlying catalyst: money printing. With the Fed's manipulation of interest rates, plus its debt monetization every ~4 years at the resolution of each credit cycle, the erosion of the US dollar's purchasing power is accelerating, young people are paying attention, and they want it fixed:

Lo and behold, people are not even remotely positive about the economy turning around. The preliminary data for May in the University of Michigan's consumer sentiment survey all missed expectations badly. People are souring on the economy, they think prices are going to accelerate, and they are not optimistic about the future. Wall Street is raving but Main Street is suffering. And a huge component of Main Street, or the asset-poor, are these young people:

As a function of this faltering economic and monetary confidence, young people are looking to bitcoin as the only way to secure their financial future. A place for them to save that won't be eroded by 4-5% every year, and won't be sliced in half if they decide to cash out and retire before 65. It has taken center stage as the solution to the wealth problem in the eyes of the youth, therefore it has taken center stage for one of the key voting blocks in the upcoming election.

You'd think this would be a no-brainer for vote buying, but for the incumbent administration and his party, it hasn't been. To say the candidate's policy stances on bitcoin are disparate would be an understatement.

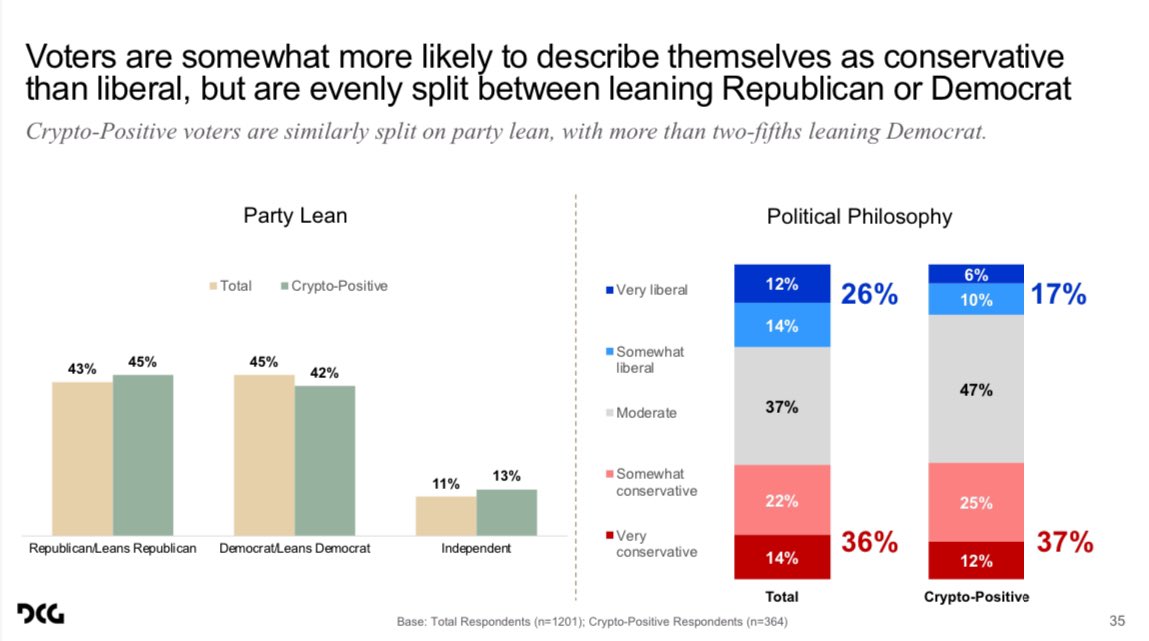

While bitcoin is a bipartisan issue, in that people who view it positively are from both sides of the spectrum, Democrats have chosen to make it a partisan issue, willfully handing over voters to the Republicans in the process:

Here's the breakdown comparing the two leading Presidential candidates, and you'll see that one is avowedly anti-bitcoin while the other is not:

Joe Biden's Stance:

- Signed an executive order to regulate the industry by throwing the book at it, under the guise of consumer protection, financial stability, and illicit finance; the usual jargon used to dissemble government overreach campaigns.

- The Biden administration proposed a crypto mining tax and a 'wash sale rule' for digital assets in the 2025 budget. This will kneecap miner revenue and the industry's already thin margins, and hurt trading liquidity in bitcoin.

- The Biden administration supports the creation of a CBDC. Orwellian oversight money that you don't actually own, can be limited or taken from you at a moment's notice, can have a specific interest rate set just for you depending on how you're behaving, and more. No privacy, ownership, or finality. Very bad.

- A bill to strike down the SEC's crypto accounting policy, one that would lead to banks being able to custody bitcoin for customers, has passed the House. Joe Biden has promised to veto it should it come across his desk.

Donald Trump's Stance:

- He is open to a more moderate and supportive regulatory framework, but globally competitive so the U.S. can "keep (bitcoin companies) here." He further added "If we're going to embrace it, we have to let them be here."

- Has shifted from bitcoin being a "disaster waiting to happen" to saying "I'm good with it"

- Has said he would "never allow for the creation of a Central Bank Digital Currency", which has been met with thunderous applause at each step of the campaign trail.

While Trump's stance is warming up from tepid room temperature, it, among other factors, is helping him in the polls. For the first time ever, Donald Trump has been leading in the polls handily for months on end, and is projected to win the 2024 election, albeit by razor-thin margins across plenty of lean-red states:

As Bitcoin gains traction as an asset, its importance to voters rises. Young people who see their wealth evaporating due to economic forces look to bitcoin as a hedge against that deliberate erosion.

This generation faces financial challenges unlike those of previous generations. With inflation eating away at their savings and debt burdens high at the personal and national level, they see Bitcoin not just as an investment, but as a financial lifeline, and a political statement. 2024 is shaping up to be a bitcoin election.

Final thought: the decay is intentional, you have to save yourself.

Take it easy,

Joe Consorti

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.